Deep Dive: New Oriental Education (EDU)

20% revenue Cagr and 30%+ earnings Cagr over the next 5 years, trading at 27x PE

Disclaimer: this research is for informational purposes only. This is NOT a recommendation to buy or sell securities discussed. Please do your ownwork before investing your money.

Update: this report was updated on Aug 1st, 2024 to reflect changes after the recent spin-off of Dong Yuhui’s live streaming channel “Time with Yuhui” from East Buy (a subsidiary of EDU) and the release of the FY24Q4 earnings (May quarter).

High competitive moat in the emerging non-academic tutoring industry; c.20% revenue Cagr and 30%+ earnings Cagr (ex-East Buy) over the next 5 years; successful turnaround from significant industry crackdown in 2021

Current price: US$61.75 (2024.8.1); Target price: US$153

EDU (New Oriental Education & Technology Group) is a leading private educational service provider in China. In 2021, the education tutoring industry, including EDU, encountered significant challenges due to China's "double-reduction" policy, which banned all for-profit K9 academic tutoring - a major revenue source for the company at the time. As a result, the company's stock price plummeted from the peak of $196 per share in Feb 2021 to just $10 in Mar 2022 (a 95% drop). Despite these adversities, EDU successfully navigated the crisis by diversifying its business - it introduced new ventures such as non-academic tutoring, intelligent learning systems, e-commerce, and tourism, effectively transforming its business model and reigniting growth. Remarkably, within just two plus years of transformation, the company’s revenue already recovers to its 2020 peak in 2023, while its stock price is still just c.30% of its peak level. Given the strong growth engines now driving the business, I am optimistic about its prospects over the next 3-5 years. I think the market may be underestimating how long EDU can sustain this high growth phase, and believe now is an opportune time to invest in the company. I recommend buying the stock with a 100%+ upside from the current price.

(Notice: EDU’s fiscal years end on May 31st. For the purpose of this report, I refer to FY2024 as 2023, representing the period from June 1, 2023 to May 31, 2024)

Investment thesis

Strong offering in non-academic tutoring: following the double-reduction policy, non-academic tutoring has emerged as one of the highest-growing sectors within the education industry in China. As a leading player, EDU now enjoys stronger competitive advantages than it did in K12 academic tutoring, thanks to reduced competition and higher barriers to entry; EDU has also demonstrated strong entrepreneurial spirit in local level and offers a more diverse range of courses, which contributes to faster growth

Resilience and recovery from crisis: hugely impacted by regulatory changes, EDU demonstrated remarkable resilience, surviving an industry-wide collapse that once shuttered 95% of its peers. Rather than dwelling on setbacks, the company innovated by launching new business lines including non-academic tutoring, intelligent learning systems, e-commerce, and tourism; although revenue initially more than halved, it has now (in 2023) returned to pre-policy the peak level (in 2020). This period of adversity also enhanced EDU’s brand image, as it was recognized for its tenacity during the crisis, a time when many perceived the regulatory treatment of education companies as unfair

Favorable market conditions post-regulation and post-Covid: “thanks to” the regulation, the competitive landscape in K12 academic tutoring greatly thinned, benefiting EDU’s high school business as many smaller competitors exited. Additionally, what happened during Covid in China has led to increasing preference from Chinese students to study abroad; the growth rate for EDU’s overseas test prep services soared from 1.9% Cagr in 2016-19 to c.28% in 2021-23, and growth in overseas study consulting services accelerated from 7.4% Cagr in 2017-20 to c.19% in 2021-23. Apart from the cessation of K9 academic tutoring, all other major business lines at EDU witnessed enhanced growth post-Covid and post-regulation

Improved regulatory sentiment: the government's stance on educational tutoring has softened, at least compared to 2021, in response to the economic slowdown in the country; over the past few months, we’ve received consistent feedback from the industry indicating a "neutral-to-positive" regulatory sentiment concerning tutoring services

Diversified business: five of EDU’s businesses (non-academic, high school, overseas test prep, overseas consulting, and ecommerce) contribute over 10% of the revenue each but none of them contribute more than 25% in 2023, making EDU’s business structure quite diversified and balanced; this diversification mitigates risks associated with unforeseen events - things like the 2021 double-reduction regulation - where the other business lines can continue to drive growth when one or two lines are affected. Additionally, there are synergies between the segments - for example, the overseas test prep service directs traffic to the overseas consulting service, live streaming ecommerce can promote the company’s tourism business, and non-academic tutoring for younger children feeds into the high school academic tutoring customer pipeline as the students age

Robust balance sheet: EDU currently holds US$ 4.95 billion cash and equivalents (including short term investments) as of FY24 year-end, against negligible debt - no solvency risk at all. The company founder and executive chairman is a "conservative" businessman, prioritizing maintaining a robust cash balance, an approach that played a key role in safeguarding the company during the 2021 double-reduction crisis that took out over half of its revenue. On the flip side, such philosophy means that the company is not typically generous in distributing cash to shareholders - between 2009 and 2023, EDU distributed just c.10% of its generated cash flow (incl. proceeds from IPO)

Valuation not cheap but undervalued: the company is trading at 27x 2024 net income; not cheap, but given its growth profile in the next 5 years, ex-East Buy (c.20% revenue Cagr and 30%+ earnings Cagr in 2023-28), I don’t think the current market cap fully reflect EDU’s true value - possibly due to the market underestimating the length of its growth runway. I used SOTP to value the company, reaching a US$ 25.2 billion target valuation (US$ 150 target price), which represents a 142% upside

Company history

EDU was founded in 1993 by Mr. Michael Yu, an ex-teacher from Peking University. The company started by preparing students for overseas university application exams, such as TOEFL and GRE. This focus was particularly relevant at the time, as China was seeing a growing interest among students to study abroad. EDU teachers’ motivational teaching style quickly helped it gain recognition and popularity.

The company went public in 2006 in NYSE, becoming the first Chinese educational institution to list on a major US stock exchange; it subsequently made a dual listing in HKEX in 2020. Over the years, the company developed a portfolio of businesses including overseas standardized test preparation, overseas study consulting, K12 academic tutoring, adult education, and books & materials.

The landscape for the private education market in China took a dramatic turn in 2021 when the Ministry of Education (MOE) released regulations banning all for-profit K9 academic tutoring. This policy, part of the "double-reduction" initiative aimed at reducing homework and after-school tutoring pressures on students, severely impacted EDU, as K9 academic tutoring constituted over 50% of the company's revenue.

In response, EDU quickly pivoted its K9 business to non-academic tutoring, which includes classes designed to enhance students' cultural and practical skills in areas such as logical thinking, language skills, arts, science knowledge, and programming/ robotics. This move not only aligned with the government's educational reform focusing on quality education but also proved to have strong market demands.

In addition, EDU further diversified its offerings to include services outside traditional tutoring and test prep services - it expanded into sectors such as intelligent learning systems, ecommerce, and even tourism. These ventures allowed EDU to leverage its brand and educational expertise in new growth areas, to capitalize on the evolving educational needs and preferences in China. The company remains a leading player in the educational sector, recognized for its innovation, quality of service, and robust business model. Impressively, within just two plus years of transformation, the company’s 2023 revenue is projected to recover to 99% of its 2020 peak.

Non-academic tutoring (14% of revenue in 2023)

Introduction to the business: provides a diverse range of enrichment classes to students across 60+ cities, covering subjects such as programming, robotics, drawing, calligraphy, debating, bilingual drama performance, reading comprehension, logical thinking, brain development, Go, and entrepreneurship. These classes are designed to enhance the cultural and intellectual development of young children, with a focus on small class sizes (<= 25 students per class). Although the business constitutes only c.14% of the company's revenue in 2023, I believe it will have significant growth potential in the following years (projected Cagr 35-40% in 2023-28).

Strong demands from the market: EDU launched this initiative as a direct response to the double-reduction policy, which effectively abolished traditional K9 academic tutoring. The courses not only foster the overall competencies and skills of children, but also serve as alternative educational opportunities for school disciplines - for example, the analytical and reasoning capability learned in brain development classes can be helpful to the math subject; the reading comprehension class is relevant to Chinese study; and the bilingual drama performance class can improve children’s English speaking skills. Despite the ban on academic tutoring, the ongoing pressure for students to excel academically and secure placements in better schools remains. While these classes do not directly follow the school curriculum, they lay a foundation for academic improvement in these subjects.

On the other hand, courses in areas such as arts, programming, entrepreneurship, and debating - though not tied to school curriculum - are crucial for cultivating well-rounded students. These classes align perfectly with the government’s policy direction towards "quality education" and offer a broad array of options. Previously, young children often pursued music and sports to broaden their interests, but now they have access to a more diverse, interesting range of activities.

Sustainability of the growth: one major question mark I had initially was the long-term sustainability of non-academic classes, as many of them are brand new classes that simply didn’t exist in the past - do parents and students find them useful and will they continue to buy these classes in the future? Thus, I took a look at 370 EDU’s non-academic learning centers (in 58 cities) listed on Dianping, China's leading local service app (considered the go-to app for China consumers when they make offline store decisions). The result revealed an impressive average rating of 4.82 stars (out of 5) for the 300+ schools, indicating high customer satisfaction

(Exhibit: Reviews of 370 EDU schools listed on Dianping - average 4.82/ 5.00)

However, I do see 22 learning centers (out of 370 total) having ratings below 4.5 stars - which is generally considered the benchmark for "good reviews" on this app. Upon closer examination, it occurred that their lower ratings are primarily caused by insufficient number of reviews, which affects the reliability of Dianping's score shown on the front page. When I opened up the detail page of these stores and went through individual reviews one by one, I found that the majority of them were 5 stars, with some 4.5 stars, and only occasional below-4-star reviews. Moreover, it appeared that many of the low score reviews were not fair or reasonable. For example, one 2.5-star review under the “7th Gaoxin Road” campus in Nanchang city said, "I did not try their classes; I just attended a pop-up event in Wuyue Square" - bravo to this customer who populated a negative review to a store that he or she did not even go to.

(Exhibit: Details of EDU schools that have <4.8 reviews on Dianping)

The retention rate for EDU’s non-academic classes - defined as the percentage of students who continue to attend the same class in the following semester - tells a similar story. EDU’s current retention rate is 70%+, an improvement from 60% the previous year, and is nearing the pre-policy retention rate of c.80% for K12 academic tutoring. Retaining a student in non-academic classes is generally more challenging than in academic tutoring, as there isn't a direct reflection of the former's impact on school grades.

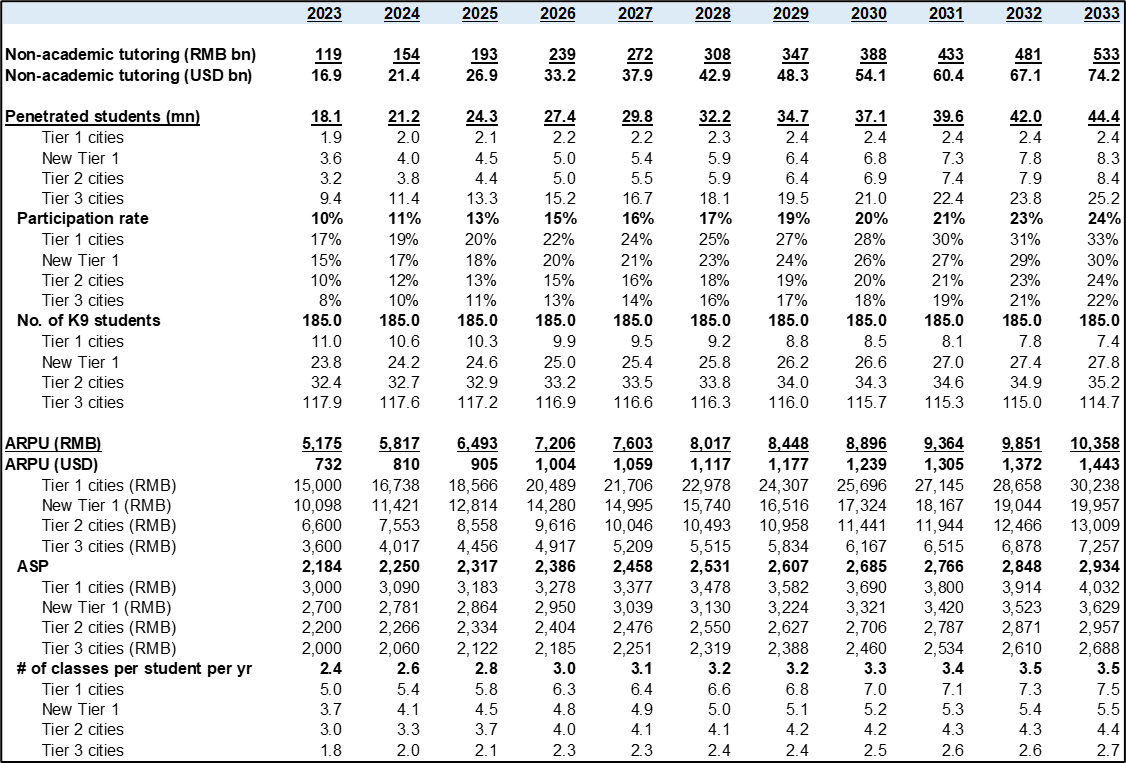

Market sizing: I sized the non-academic tutoring market in China, excluding music and sports, at $17 billion in 2023, based on a 10% participation rate among the total K9 population and an ARPU of $732. EDU’s market share is 3.4%, vs. major competitor TAL’s at 4.1%, with the latter including 1.7% from online, a segment perceived as lower quality due to its slower growth and lower margins - non-academic tutoring is simply not that suitable to online teaching. The combined market share of EDU and TAL, 7.5%, is lower than their combined share in K12 academic tutoring pre-policy, at c.12%.

(Exhibit: market sizing of China’s non-academic tutoring market (ex-music/ sports))

Enhanced moats for leading organizations: I believe top firms EDU and TAL have higher moats in non-academic tutoring compared to previously in academic tutoring, and thus shall achieve higher market share than they did in academic tutoring pre-policy (combined ~12%):

Reduced competition: the double-reduction policy reduced the number of tutoring organizations by ~90% of pre-policy level; many second-tier institutes (such as One Smart and Yousheng) have ceased operations, and most online players (such as ZYB, Yuanfudao, and Gaotu) are ill-suited for non-academic tutoring, which relies heavily on offline formats

Higher R&D demands: non-academic tutoring is a nascent field that necessitates significant entrepreneurial effort and R&D resources; this is a challenging endeavor for smaller, less-resourced organizations. In academic tutoring, smaller organizations could simply recruit public school teachers to deliver OK-quality teaching, but such playbook does not really work for non-academic tutoring, where many courses - such as robotics, science exploration, debating, brain development, drama performance, and entrepreneurship - are entirely new and not even taught in school. Moreover, in the past, EDU & TAL contended with significant competition from private tutoring sessions held by individual school teachers in their homes; such an arrangement is also unlikely to be replicated in the non-academic sector for the same reason

Increasing importance of brand: convincing parents to invest in something as novel as non-academic tutoring is not straightforward. The reputation that EDU and TAL have built over the years can help them overcome initial hesitations from parents unfamiliar with the benefits of non-academic courses

Between EDU and TAL, I like EDU’s non-academic business more:

Wider operational reach: EDU's non-academic classes are offered in 60+ cities, compared to ~30 for TAL; this disparity stems from TAL significantly reducing its presence - from 108 cities to about 30 - following the double-reduction policy, whereas EDU maintained operations in most cities, supported by its ongoing operations in fields unaffected by the policy, such as overseas study test prep/ consulting, adult education, and a larger (than TAL’s) high school business. Resuming operations in cities previously exited would require additional effort, and TAL seemed to have not much intention to expand cities - focusing mainly on Tier 1 and 2 cities. EDU's broader city network positions it well, as non-academic demand has been strong in both high and low tier cities. EDU presents the opportunity to capitalize fully on the burgeoning non-academic tutoring industry

Greater entrepreneurship at the local level: historically, EDU has adopted a more decentralized, bottom-up approach compared to TAL’s centralized strategy, allowing regional principals and teachers greater autonomy and flexibility in managing local businesses. In non-academic tutoring, such philosophy has enabled EDU to innovate more quickly at the local level - developing a wider course offerings, including unique classes not found at TAL, such as classic literature reading, entrepreneurship, debating, drawing, and calligraphy. Additionally, the courses offered by EDU vary from city to city, likely tailored to regional demands and the specific strengths and expertise of local teachers; in contrast, TAL tends to offer the same 6 categories of classes across all cities. Given that non-academic tutoring is an evolving industry, EDU's more dynamic approach is likely to yield greater growth opportunities and faster expansion. From 2022 to 2023, EDU's non-academic service revenue per learning center grew from 63% of TAL's to ~80%, marking impressive progress, especially considering TAL’s previous dominance in the K9 population.

High school academic tutoring (25% of revenue in 2023)

Introduction to business: provides small group classes and 1-on-1 tutoring for high school students in subjects tested in the "Gaokao," China's national college entrance examination, including math, Chinese, English, and natural/ social sciences. Unlike K9 academic tutoring, high school academic tutoring was not banned under the 2021 double-reduction regulation.

Market sizing: I sized the market at US$8.7 billion in 2023, based on a 33% tutoring participation rate among "normal high school" students (excluding those in vocational high schools) and an ARPU of ~US$900. Within this market, EDU holds a 12% share, compared to TAL's 3%. EDU's market share has notably increased from pre-policy level (c.6%), largely because many of its K12 institutional competitors closed down post-policy.

(Exhibit: market sizing of China’s high school tutoring market)

Supply/ demand mismatch: despite a significant reduction in supply due to regulatory changes, the demand for academic tutoring remains robust. This is because the college selection mechanism in China, “Gaokao”, has not changed. With a bachelor’s degree acceptance rate of ~40% and increasing pressure on employment post graduation, students and parents continue to seek advantages in academic performance, creating a clear mismatch between the demand and the available supply of tutoring services. In response to this mismatch, EDU now has the chance to grow its high school business quickly, even at the current market share level; however, the company is "controlling” the growth, as the IR suggested, to not exceed 20% too much, in order to mitigate regulatory risks - although high school tutoring is now permitted, EDU is cautious about not drawing excessive government attention. Based on such a dynamic, I believe EDU should be able to comfortably grow this segment at at least 15-20% Cagr.

EDU vs. TAL: Between EDU and TAL, I like EDU’s high school business more. For one, EDU has historically stronger brand recognition among high school students (vs. TAL’s emphasis on younger kids). Then, post-policy, EDU has further extended its lead in the high school segment as it retained operating licenses in most cities, while TAL exited most cities with many licenses not renewed, making resumption of operations more challenging. EDU's high school business saw a 25% growth in 2023, outpacing TAL's growth rate of 17%.

Overseas study test prep & consulting (24% of revenue in 2023)

Introduction to business: provides standardized test preparation (TOEFL, IELTS, SAT, GRE, GMAT, etc.) and consulting/ agency services for students planning to study abroad.

Accelerated growth post-Covid: the sector was growing at c.8% Cagr in 2016-19, but accelerated to c.19% Cagr in 2020-23. The surge was fueled by a growing preference among Chinese youth to study abroad following the pandemic, coupled with more favorable competitive dynamics - during Covid, many smaller-sized firms exited the market due to a decline in business, attributed to travel restrictions and disruptions in study abroad activities.

Competitive dynamics in overseas test prep market: EDU holds a leading position in this market with close to 20% market share in 2023. For nearly three decades, it has been regarded as one of the most reputable and well-known brands in the field, celebrated for its outstanding teachers who are popular with students.

Competitive dynamics in the overseas study consulting market: EDU is a key player alongside other top firms such as Shinyway, JJL, EIC Edu, and Aoji. EDU's unique advantage lies in its ability to offer a comprehensive one-stop solution, taking care of both application consulting and test prep under one package. However, when considering the consulting services in itself, I don’t see EDU possess distinct advantage; thus, I expect the company’s growth in consulting service to generally align with “industry beta”.

Tourism (1.5% of revenue in 2023)

Introduction to business: offers study camps and tours for students, as well as cultural tours for adults. The student study tours span 13 foreign countries and 110 domestic cities, featuring a diverse array of themes including natural exploration, cultural enrichment, career exploration, business training, and university experiences. The adult cultural tours cater to the high-end market, with each group receiving guidance from a specialized cultural tour guide, often a former EDU teacher; these guides bring a deep cultural knowledge and insight, providing an experience that transcends typical travel tours.

Explosive growth post-Covid for study tours: EDU’s study camp/ tour offerings align closely with the "quality education" now pushed forward by MOE - the tours provide children with hands-on, experiential learning that diverges from the traditional “rote learning” often used in Chinese education, enhancing soft skills and overall competencies. Following increased interest in these educational experiences, the sector is seeing exponential growth, with the company guiding close to 200% yoy growth for the tourism sector in 2024.

Innovative creation of the adult tour business: EDU's adult culture tours stand out in the market by focusing on cultural enrichment, appealing to people who seek both enjoyment and educational value in their travel. These premium tours are enhanced by EDU's extensive network of high-quality teachers, whose excellent communication skills and deep knowledge make them ideal cultural tour guides. EDU also leverages its Douyin live streaming account "East Buy" to promote these tours, with hosts traveling to various Chinese provinces to showcase local products.

Intelligent learning systems (7% of revenue in 2023)

Introduction to business: sells a range of K12 learning devices, with the primary product being the learning tablet provided under a subscription model - tablets are lent to students who participate in EDU's after-school care sessions at a cost of RMB 1,000-1,500 (US$ 140-210) per semester; On the tablet, students can access recorded classes and participate in live Q&A sessions. Other learning devices are primarily sold through a direct sales model

Lack of product advantage but a fairly profitable business model: I don’t see EDU’s learning tablet product as strong as top competitors’ (TAL and iFlytek). While the latter sell their tablets directly to consumers with premium models priced at RMB 8,000+ (US$ 1,100), EDU's tablets are “sold” by bundling with its after-school care services - students who want to attend the after-school care sessions have to rent the learning tablets - which tells me that the tablets may not be as appealing if sold separately. I think growth in this sector should be less driven by the learning tablet market but more by demand for EDU’s after-school care service. Nonetheless, this business model is quite profitable, with an EBIT margin that is even slightly higher than that of EDU’s non-academic tutoring services.

Ecommerce - East Buy (22% of revenue)

Introduction to business: EDU introduced this business as a strategic response to the double-reduction policy that impacted over half of its previous revenue. The company engages in livestream sales of private label and third-party products mainly on Douyin. The initiative particularly took off when Dong Yuhui, a former EDU teacher and former host for East Buy, became popular for his informative broadcasting style - a refreshing contrast to the more sales-centric approach typical of most other hosts in the industry. East Buy is a public company, with EDU holding a 57% majority stake.

Reflection on management capabilities from East Buy’s initial success: EDU's early achievements in ecommerce highlighted the ability of Yu Minhong and the management team to remain composed and innovative amidst crisis. E-commerce was not directly related to EDU's core tutoring offerings, but the company creatively leveraged its resources of capable teachers to carve out a role for itself in the new market. This strategic pivot, executed swiftly and decisively, demonstrated the company's resilience and adaptability.

Valuation approach: However, I'm generally skeptical about the sustainability of the livestream e-commerce business model due to its high volatility and the rapid shifts in consumer preferences. The recent exit of Dong Yuhui serves as a stark example of how the departure of a key individual can significantly affect the business. Considering East Buy operates as a publicly traded entity, I use its market cap as the "fair assessment" of its value, and apply a 50% discount to maintain a sufficient margin of safety.

Other businesses (7% of revenue)

Adult education: offers test preparation courses for university students and adults in China, focusing on exams such as the College English Test (CET) Levels 4/6, the post-graduate entrance exam, and career-oriented tests like the civil service exam. The growth of this business is driven by the intensifying competition in China's job market, prompting university students and recent graduates to pursue additional training or extend their studies to enhance their job prospects.

Others: mainly book selling and publishing services

Management and corporate governance:

Company founder and executive chairman, Mr. Yu Minhong, is a "conservative" business person when it comes to managing financials, prioritizing maintaining a robust cash balance. This cautious approach played a key role in safeguarding EDU during the 2021 double-reduction crisis that led to the closure of ~95% of K12 tutoring companies in China - at that time, EDU had $6.3 billion in cash and equivalents (vs. $4.3 billion revenue for the year). However, this conservative approach also means that the company is not typically generous in distributing cash to shareholders - between 2009 and 2023, EDU distributed just c.10% of its generated cash flow (FCF + IPO proceeds).

Another aspect to keep an eye on is Yu's public presence. Yu likes to participate in public interviews, presentations and TV programs, and has not always been careful about what he says. For instance, his recent (May 31) remarks during a livestream chat with another businessman regarding East Buy’s broadcasting business triggered a ~20% decline in East Buy's stock price within a week (and a ~6% decline in EDU’s price); 6 years ago, Yu made some other controversial comments about "women in China," resulting in a public apology of his at the Women's Federation in China. I don't think it's the best corporate governance practice for a company founder/ top executive to discuss his/ her personal feelings about the company in public (it's like Elon Musk talking about Tesla on Twitter). However, Yu's habit of voicing his views in public is unlikely to change soon, and this is a situation that investors of EDU would have to deal with.

Finally, Yu's handling of the recent spin-off of Dong Yuhui’s channel, “Time with Yuhui,” has raised my concern over his treatment of minority shareholders. According to Yu's message in his WeChat circle, the channel was transferred to Dong at no cost, in addition to Dong receiving Rmb 140mn of the total net profits accumulated over the channel's half-year operation. While this move has enhanced Yu's public image and may have generated positive sentiment around EDU's business, it does not seem to align with the best financial interests of EDU and East Buy's small shareholders. Essentially, they are relinquishing the “Time with Yuhui” channel, which generates more GMV than East Buy’s main account, without any direct benefits.

Financials:

Top line. expected to grow by 20% Cagr (ex-East Buy) from 2023 to 2028 driven by:

High school tutoring: growing at 15-20% Cagr from 2023 to 2028; the company is having excess demand from the market but is “controlling” the pace of its growth due to cautious regulatory considerations

Non-academic tutoring: growing at 35-40% Cagr in 2023-28; we’re still at the early stages of a prolonged period of high growth, driven by robust demand and EDU's strong competitive advantages in the market; my revenue forecast for this segment in 2028 suggests a market share of 6.9%, only slightly above its pre-policy market share in K12 academic tutoring, even though its competitive moat has broadened in this new market (I think the market can be underestimating the length of EDU’s growth runway in this segment)

Overseas study test prep/ consulting: growing at c.15% Cagr in 2023-28, driven by increasing preference from Chinese students to study abroad, coupled with EDU’s dominant position in overseas test preparation market

Intelligent learning systems: growing at c.10% Cagr in 2023-28 (vs. 40%+ Cagr in 2021-23); I stay relatively conservative on this segment because of the lack of confidence on the company’s learning tablet product

Tourism: growing at high double-digit Cagr in 2023-28, but still small in revenue now (2% of total revenue in 2023), driven by explosive demand for study tours post-Covid; the company is guiding a c.200% revenue yoy for 2024

Others: growing at c.10% Cagr in 2023-28 mainly driven by adult education, which the company guides to grow by c.25% in 2024

Regarding eCommerce - East Buy: revenue to drop by 50% in 2024 due to spin-off of the “Time with Yuhui” channel in July 2024; it then grew at 7% Cagr for the next 4 years. I stay conservative on the segment because of the lack of visibility of it; revenue outlook of this segment does not influence my valuation of EDU as I used SOTP approach that isolates East Buy and value East Buy based on its current market cap

Bottom line. EBIT margin (ex-East Buy) to improve from 9.1% in 2023 to 15.0% in 2028 driven by:

High school tutoring: EBIT margin expansion of 2 ppt from 22% in 2023 to 24% in 2028 driven by increasing penetration of OMO (online-merge-offline) and achieving greater economies of scale; company guided 1 ppt margin expansion from 2023 to 2024

Education new businesses (non-academic & intelligent learning system): EBIT margin expansion of 2 ppt from 20% in 2023 to 22% in 2028 driven by improving utilization of non-academic learning centers; its mix increase will also benefit overall OPM due to its higher segment margin than Group average

Overseas study test prep/ consulting: EBIT margin expansion of 2 ppt from 15% in 2023 to 17% in 2028, driven by company achieving higher operating leverage as the business scales and learning center utilization further improves

Other businesses: EBIT margin to improve from 2023 to 2028 - adult education from 5% to 12%, ecommerce from 5% to 8%, and tourism from -15% to 10%

Return metrics: both ROCE and ROIC are meaningless due to the company's negative net working capital and negative net debt. ROE reached 8% in 2023, up from 4% in 2022, although still below pre-Covid level of 15%+, mainly because the company’s net margin is still recovering from the trough during double-reduction regulation.

Capital allocation: from 2009 to 2023, the company has deployed its generated cash flow (including cash received from IPO) in the following manner:

30% on capex: mainly learning center renovation costs to support ongoing operation of its offline business

10% on shareholder distribution: mainly in the form of share buyback and partially in the form of dividends

60% on cash & equivalents (including short-term investment) on balance sheet: increasing cash & equivalents balance from US$420 million in 2009 to US$5 billion in 2023

Valuation: the company is currently trading at 27-28x 2024 earnings and 19-20x 2025 earnings; such multiple is not low, but I believe the current market cap undervalues the company’s strong growth potential for the next 5 years (c.30% earnings Cagr ex-East Buy). I used SOTP to value the company: for East Buy, I apply a 50% discount to Group’s 57% holding of the public subsidiary, which is trading at US$ 1.4 billion, reaching US$ 0.4 billion valuation; for the rest of the business, I used DCF to reach a valuation of US$ 24.8 billion. The total valuation of US$ 25.2 billion, or per share price of US$ 150, suggests a 100%+ upside.

Pre-mortem

(I use pre-mortem analysis instead of risk analysis to encourage more proactive problem identification.)

Non-academic tutoring business, despite being a focal point, lost momentum as it turned out there wasn’t substantial demand in this area, leading to less growth than anticipated

Regulation sentiment shifted unexpectedly from a "neutral-to-positive" stance to more restrictive measures on tutoring activities. This led to either banning of EDU’s high school tutoring business, accounting for 25% of its revenue, or imposing constraints on new ventures in non-academic tutoring and intelligent learning systems, currently making up 21% of the revenue

Regulatory constraints on the live streaming e-commerce business posed challenge to sustainability of East Buy’s business (though this is less critical as East Buy only constitutes ~3% of my valuation of the Group)

Yu Minhong, the 61-year-old founder, scaled back his involvement in the company due to age, leading to a loss of direction as the new leadership struggled to match his innovative and characteristic approach and drive the business to success

I linked to your post in my Monday links collection post: https://emergingmarketskeptic.substack.com/p/emerging-markets-week-august-5-2024

I also have some write-ups about Brazilian & South African education stocks: https://emergingmarketskeptic.substack.com/t/education-stocks