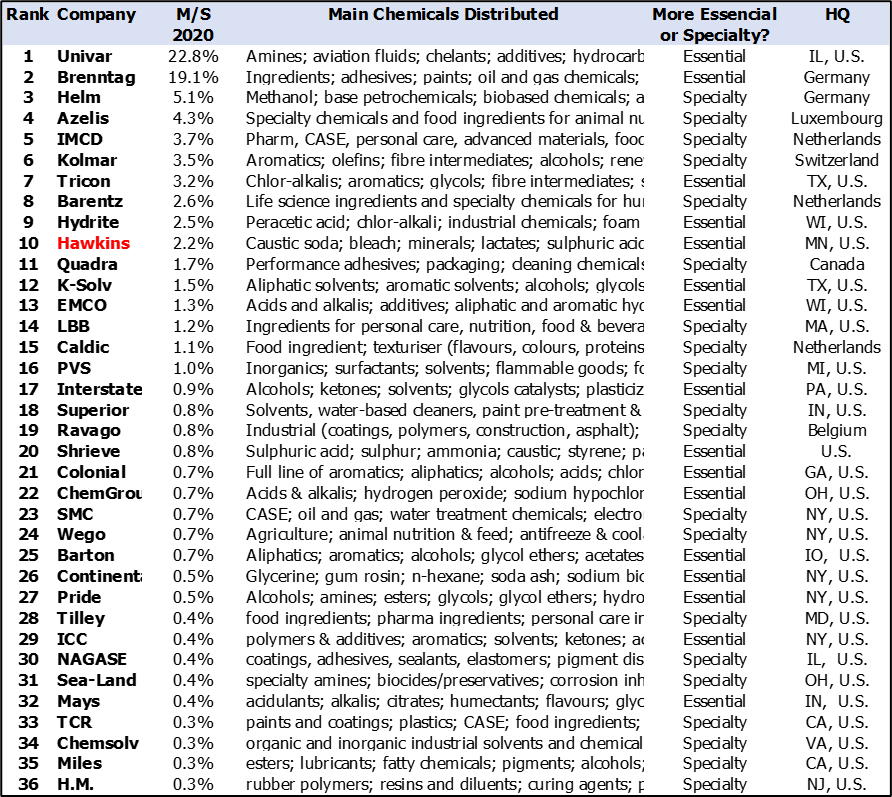

Deep Dive: Hawkins (HWKN)

Resilient distributor model; Smart capital allocation; Strong edge and long runway in the water treatment segment; Valuation too high and cyclicality may not be in favor next year - Short

Disclaimer: this research is for informational purposes only. This is NOT a recommendation to buy or sell securities discussed.

Note: Hawkins’ fiscal year ends on March 31st. For the purposes of this report, I refer to FY2024 as 2023, which covers the period from April 1, 2023, to March 31, 2024. This convention applies to all preceeding and subsequent years as well.

Hawkins (HWKN): Resilient distributor model; Smart capital allocation; Strong edge and long runway in the water treatment segment; Valuation too high and cyclicality may not be in favor next year - Short

2024/10/15 (current price $132.8)

Hawkins is a chemicals distributing company in the U.S. operating three businesses: (1) chemicals distribution; (2) water treatment (both chemicals and treatment services); (3) health and nutrition ingredient distribution (essentially a more specialised “chemical”). Company’s stock price has gone up quite a lot recently, up 120%+ LTM. While I believe the business is solid with still a very long runway for growth, the current elevated share price calls for caution. The firm’s strong financial performance in the recent fiscal year (FY2024) is partially driven by favourable seasonality, which could shift in the coming couple of years. My DCF model suggests a 25-30% downside, and I rate the stock as Short, with a target price of $97.

In a nutshell

Resilient model: as the middleman, Hawkins is in general able to pass along the volatile price movement from the upstream to downstream, thus enjoying a stable and consistent margin profile - averaging 18.9% GPM from 2010 to 2023 (variations ranging from 17.2% to 21.9%)

Strong working capital management: the company has managed to maintain a very stable cash cycle (62-65 days) over the last 5-year span, showing strong and consistent inventory management execution in a generally volatile chemicals industry

Smart capital allocation: company spends ~45% of its FCF on M&A (mostly on the water treatment segment, where the company has higher moats) to drive a long-term ROIC of c.10%; it then returns 25% to shareholders for a c.1% yield (based on the recently heightened stock price)

Solid operation & long-term thinking: Hawkins is reputed in the industry for solid execution and proactive customer services. CEO believes in doing the right things in business, and satisfactory capital market returns will naturally follow in the long run

Focused regional build-out: different from some peers that try to expand globally, Hawkins has been very focused on the middle part of the U.S. geography, building strong supplier and customer relationships that are hard to be replaced

Long growth runway for the water business: competition level appears to be low in this market, where Hawkins exhibits clear competitive advantages in chemicals pricing and service execution. With the help of acquisition, I feel there is a very long runway for Hawkins to expand and consolidate the market

Cyclicality may turn unfavorable in the next couple of years: in 2023, the company benefited from favorable cyclicality, with falling raw material prices boosting profits and releasing LIFO reserves. Industry cycles typically last 2-3 years, and I believe it’s likely that the company will face headwinds in the coming couple of years, impacting its margin profile

Current stock price too high: I expect the company to be a Hsg% net income grower for the next 5 years, with 1% additional yield from shareholder returns. This profile is OK for the previous multiple of avg. 13x in 2021-2022, but at the current forward P/E of 30x+, it looks too expensive to me. My DCF model suggests a 25-30% downside, with a target price of $97

Presentation

Hawkins was founded in 1938. Right from the beginning, the company stressed service. Its rapid growth has been attributed both to its development of strategic alliances with manufacturers and its strong recognition from clients. In 1938, Hawkins distributed 12 products; today, it provides businesses and communities with thousands of products.

Historically, the company had been a regional player mainly serving the midwest region of the U.S.. Since 2013 the company has conducted a series of acquisitions in the water treatment sector to expand its footprint to southern U.S. including Florida, Texas, Louisiana, Tennessee, Alabama, and Georgia.

Industrial: the fundamental cores (45% of revenue in 2023)

The business: Hawkins resells commoditized and specialty chemicals to a wide range of downstream markets including electronics, energy, metals, mining, paper, personal care, food & beverage, and medical. The company also provides value-add services by manufacturing, blending, and repacking chemicals, which now represent c.85% of the segment’s revenue. Hawkins mainly serves the midwest region in U.S.

Value propositions: for principals (chemical manufacturers), they need distributors for handling the complexity of serving hundreds of smaller customers on logistics, warehousing, customizations, and customer services. For customers, they need distributors for (1) getting chemicals in different package sizes, concentrations, and grades; (2) buying multiple chemicals from one place; (3) securing chemicals in demand especially when there is supply chain disruption; (4) meeting immediate needs of chemicals. Indeed, smaller buyers may only be able to buy from distributors as their order sizes are not large enough to warrant direct service from principals

Hawkins’ main advantages: through 80+ years of focused development in the midwest U.S., the company has established a strong reputation and strategic alliance with upstream suppliers - when there is turmoil and volatility in the supply chain, it is in a better position to secure volume or get preferential prices. The company is also reputed for providing superior customer services and high willingness to offer customised solutions for the local clients. Such trait is valued in this industry as distributors are an integral part of clients’ supply chain and it’s crucial to have a smooth collaboration between the two parties

Pricing and cyclicality: as the middlemen, distributors in general are able to pass along the volatile price movement from the upstream to downstream, thus enjoying a stable and consistent margin profile. When price is going up, the downstream usually becomes more “desperate” for supply, in fear of further price increase, and distributors are able to charge higher GP per ton. When price is going down, the pressure goes to the principal side to offload production, and distributors are able to gain advantageous in-take price - however, they themselves also have higher pressure in this case to quickly clear their inventories at hand which were taken in at higher price points previously. When the two sides are under contract (>50% of the chemicals are sold under contract) for a period’s supply, the price will become more rigid. Distributors shall seek compensation in other formats or in the next contract when price is trending up, and would usually pocket the additional profits when price is trending down. However, longer contracts usually have clauses allowing for price adjustment periodically based on some market indices, allowing both sides to adapt more flexibly

Recurrence: I don’t feel the chemical distribution business is highly recurring. Granted that distributors provide essential inputs to customers’ production process and the demand is continuous, but customers always have the freedom to change to another distributor who can supply the same chemicals, especially after the current contract ends. Therefore, distributors need to keep on winning deals and provide good service to existing customers to improve their chance to be reselected

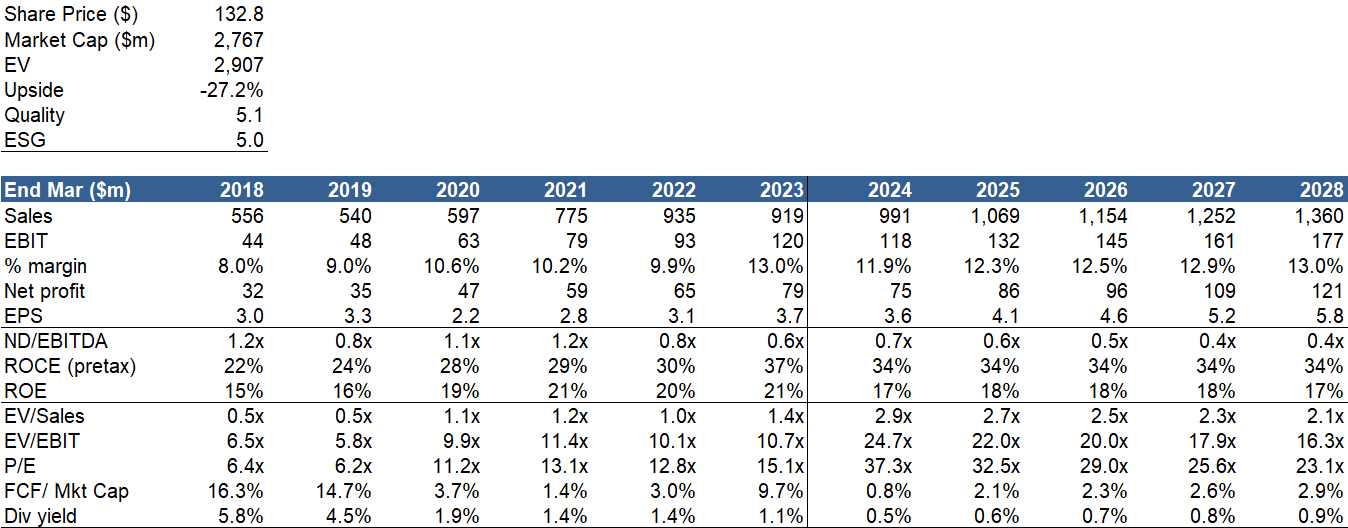

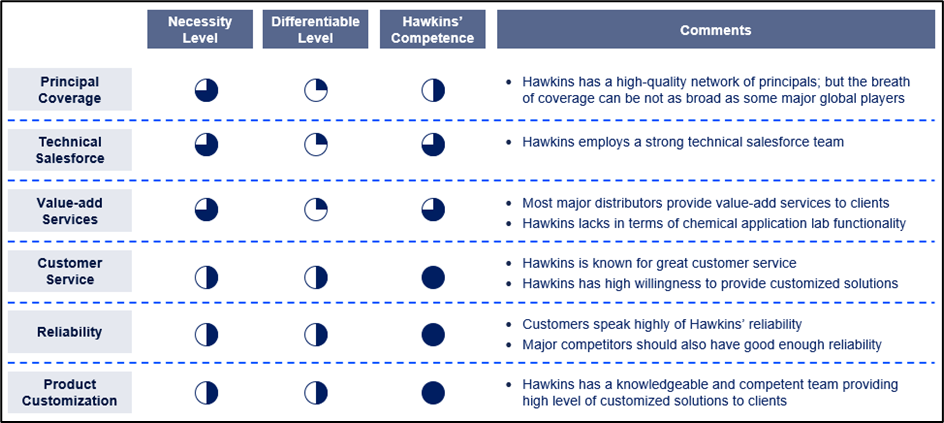

Competition: the chemical distribution market in the U.S. is fragmented. Hawkins is ranked no.10 in terms of revenue with ~2% market share (see appendix for the list of top 36 chemical distributors in the U.S. and their m/s). I feel competition in this market is in general less differentiated - major players usually all have a wide enough range of chemicals they represent, the capability to provide value-add services such as blending and repackaging, and a technical sales team that takes client calls - which are really the key “wants” from the customer base. Hawkins differentiates itself in more qualitative aspects including customer service quality, product customization, and supply chain reliability, but these attributes are not exclusive - other companies can still provide them at some level - and not considered “must-haves”. Therefore, we think it will be hard for Hawkins to earn much excessive returns in this market

Market consolidation: some other big players, not Hawkins, have been actively acquiring smaller players in this industry who can experience more struggles for survival as principals are now increasingly looking to consolidate their distributors base. However, I think the returns on these investments are not high due to the limited competitive moats and synergies they can bring, as well as the heightened acquisition price due to a more crowded buyers market. Hawkins has done 0 acquisition in this field since 2010, which I think is prudent

Margin profile: GPM of the segment has been around 15% and relatively stable due to the company’s ability to efficiently pass long price volatility. GPM is lower than that of the water treatment business because of the more undifferentiated competition, and less service elements involved. SG&A ratio was around 8-9% in the past and reduced to 6-7% since 2021, showing some operating leverage achieved by the company. Bottom line, this business now contributes a 10%+ EBIT margin

The main point: I don't think Hawkins’ chemical distribution business by itself is attractive due to the less differentiated nature of the competition. However, I do believe this business is core and necessary, as it supplies one of the very key advantage for company’s water segment, which has now emerged as the main driver for the company’s business

(Exhibit: KSF for chemical distributors and Hawkins’ competence)

(Exhibit: List of top 36 chemical distributors in the U.S. by their revenue in the U.S.)

Water Treatment: the real engine (40% of revenue in 2023)

The business: Hawkins supplies water treatment chemicals and equipment, and provides water treatment consulting services/ operational support to municipalities and industrial plants, operating as a one-stop solution provider, while most competitors in the industry focus on one side of the process - either providing operational services without in-house chemical distribution capabilities (small local vendors), or supplying chemicals without too much emphasis on the servicing part (big chemical distributors)

Value propositions: municipalities need to treat water because they have to provide clean water for the city’s residents and take care of wastewater. Industrial plants need to treat water for regulatory compliance, environmental protection, efficiency improvement, etc. and the downside for not properly treating water and breaking regulation can be huge

Pricing and cyclicality: municipalities usually sign contracts for water treatment chemicals for a certain period (1 year, 2~3 years, for example), and that makes the pricing more rigid. When the chemical price is increasing, distributors are usually not able to directly pass along the increase - out-of-cycle price adjustment requires formal submission and a lot of extra steps and processes. However, there will usually be a “catch-up” compensation in the forms of delivery/ energy surcharges, or in the next contract - thus, longer-term, distributors are still able to pass the price hike. When chemical price is decreasing, the benefit comes to the distributor side as clients are slower in responding to the market volatility and also constrained by the existing contracts. Contract terms have become shorter after Covid - during which the spike in raw material prices caused difficulties to many distributors who were locked in for low prices set pre-pandemic. Now 6-month contracts are the most common, making pricing adjustments quicker. Contracts for industrial clients are usually relatively shorter

Recurrence: the demand itself is very recurring - municipalities will always need to treat water for its residents and industrial plants need it for regulatory compliance. However, in general, each new contract needs to be re-earned - municipal customers run the bidding process each time the previous contract expires and are supposed to set up transparent procedures for multiple vendors to participate. Despite this, I feel the “retention rate” for Hawkins should be pretty high. Clients’ first priority is to ensure water is cleaned properly. If Hawkins did a good job in the previous contract - as industry feedback suggests is often the case - it is in clients’ best interest to continue using its service, as the downside of not cleaning the water properly due to change of vendor can be big. Ultimately, the retention rate hinges on "replaceability" - and the good news here is that competition in this market seems to be “weak”, and it’s rare for a competitor to have both the low chemical pricing and high quality of service/ knowledge that Hawkins possesses (more details in the next bullet point)

Competition: what customers truly care about in this market are three things: (1) how cheap are your chemicals? (2) how competent are you to solve my water problem? (3) how well do you serve? I believe Hawkins is one of the few firms in this industry that ticks all three boxes, and is in a great position to expand and consolidate the market for the years to come

Price: thanks to the core chemical distribution business, Hawkins is usually able to provide very, if not the most competitive pricing for water treatment chemicals. In comparison, most local service vendors don’t have a chemical distribution business. Such advantage is significant for price sensitive clients such as the municipalities, who usually assign high weighting on prices in their bidding process

Problem solving: water problems can sometimes be tricky to solve. Thus, having a strong technical knowhow and a proactive technical sales team that goes to clients’ sites and tests different solutions & designs are very important. Hawkins’ technicians are frequently seen on client sites, involved in designing and testing water treatment solutions for the clients. Big distributors usually don’t have the same level of localised and highly involved services that Hawkins does. It doesn’t mean that Hawkins will always get the eventual contract, but the trust and relationship it has built during the process is highly valuable and greatly improves its win rate

Customer service: customers rely on service providers for consistent and smooth support through the entire water treatment process. Hawkins has built a reputation in the market for providing great customer service and high reliability. In addition, the delivery drivers from Hawkins are usually also technicians (which is not common in this industry), and are thus able to provide on-site support each time they go out for the delivery run - a highly appreciated value-add for the clients. An industry consultant who’s worked with many municipalities in midwest mentioned that he’s never had one customer complaining about Hawkins’ services and he praised it for always being candid on its offerings

M&As: the company has conducted 12 acquisitions in this segment since 2013, expanding its reach to more southern states including Florida, Texas, Louisiana, Tennessee, Alabama, Arkansas, and Georgia. The water treatment business is a local business in nature because some of the key chemicals to treat water are not very stable (not suitable for long-distance delivery) and vendors need to be hands-on in supporting customers - thus acquisition becomes an important method for geography expansion. I believe these investments in the sector generate strong returns for Hawkins, as they focus on an area where the company holds clear, differentiated advantages and can realize synergies. The cumulative ROIC on these investments is around 10% by 2023 (see appendix for a list of acquisitions and their respective returns on investment)

Margin profile: GPM is 20%+, the highest among the three segments - due to its more customised, differentiated, and value-added offerings - even though many of its clients (the municipalities) are price sensitive. The segment does incur higher SG&A cost ratio due to more client serving and operational support. In the end, we are looking at a business with 10-15% EBIT margin (even higher in some recent quarters), which is also the highest among the three segments

Health & Nutrition: tapping into specialties (16% of total revenue)

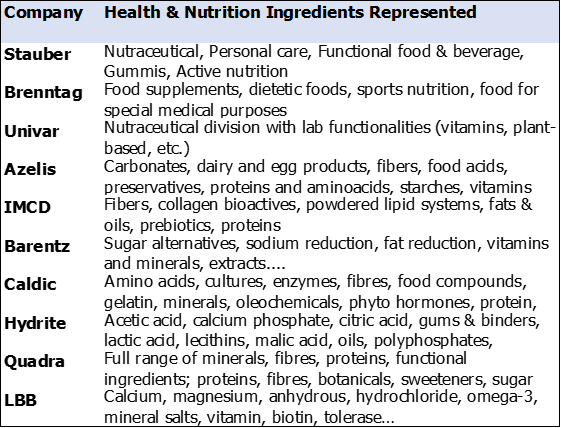

The business: Stauber (acquired by Hawkins in 2015) serves as a distributor for multiple health and nutrition ingredient manufacturers, marketing their products to downstream health product makers; it also provides manufacturing capacity in New York. Overall, the list of suppliers that Hawkins represents is of high quality, consisting of not only local suppliers, but also a significant number of international suppliers (HQ in Canada, UK, Belgium, Norway, Italy, Korea, Japan, Australia, etc.), with some operating on a global scale. Each partner appears to lead in its respective ingredient niches, and many of them have been operational for decades (see appendix for the list of key ingredient partners for Stauber)

Value propositions: nutrition ingredient distributors provide value to downstream product firms by (1) pooling demand from multiple brands and negotiate for better procurement price on ingredients; (2) helping manage the logistics (warehousing, delivery, inventory mgmt.) of sourcing from multiples manufacturers; and (3) providing quality control as well as market and regulation advices

Pricing and cyclicality: order commitment is a relatively common practice in the industry because it offers clients some volume discounts (as distributors have assurance on sales), supply chain reliability, and customised production. That means Stauber usually has good visibility of sales for the near term. In case that the order commitment cannot be fulfilled, some penalties/ fees can be expected. The business should also be relatively stable in the sense that as middleman representing a wide variety of ingredients, distributors are less affected by the constantly changing market trends and consumer preferences in the end market

Recurrence: the business, which is in essence a specialty distribution business, is more recurring than the company's other two segments. Once client products with Stauber’s ingredients are on the shelves, it will be hard for them to change suppliers because such activity may impact the efficacy of their already working products

Competition: fragmented industry with many players, most of which are also chemical distributors (see appendix the list of other market players). Stauber m/s is below 1%. The market is fragmented due to the huge variety and constantly evolving nature of nutrition ingredients - each distributor finds its own niches to play by representing different ingredient manufacturers. It’s hard for any player to dominate on the supplier side because conflict of interests will soon kick in - for example once a distributor already represents a protein from manufacturer A, it’s really hard for it to represent manufacturer B’s protein that has similar functionality. It also needs to ensure that enough attention and resources are allocated for each key principal as it needs to deliver satisfactory sales results in order to attract the principal to continue to work with it. My expectation is that Stauber should grow largely inline with market growth if not a little faster due to its better execution and customer services

Margin profile: GPM of this segment is close to 20%, higher than Industrial’s (due to the more specialty nature of the distributed products) but lower than Water’s (due to less operations and value-add involved). Company has been doing better SG&A control in recent years and lowering the cost ratio to ~10% in 2022 from 14%+ 4 years ago. Overall this business now outputs 5-10% EBIT margin

Management:

CEO Patrick Hawkins is the nephew of previous CEO John R. Hawkins, who passed away from cancer in 2011. Before becoming CEO in 2011, Patrick held various roles within the company, including Director of Food & Pharma (2009-2010), Manager of Food (2007-2009), and Sales of Food (2002-2007)

Top executives are compensated based on base salary (accounts for roughly 1/3), and incentives (account for roughly 2/3, incl. cash bonus and restricted stocks).

Incentive level is determined by % of achievement of operational targets (corporate pre-tax income and segment gross profit). 80%-100% achievement of the targets yields 50%-100% of designated bonus, and 100%-120%+ achievement yields 100%-200% bonus

Overall, I do feel that the company’s executive compensation scheme is well-balanced and rightly focusing on profitability, which may help explain its improving profitability over the recent years especially on Industrial and Nutrition segments

However, I also have some concerns: (1) The operation targets are all short-term in nature and focusing on the next FY results, which can result in executives paying too much attention to immediate wins; (2) The targeted metric, which is corporate profitability, does not necessarily directly link to shareholders return, and in some cases low quality earnings increase can even lead to multiple deration

Financials and capital allocations

Top line. Mid-to-long-term, Hawkins’ growth framework looks as below (overall Msg-Hsg Cagr)

Industrial: +4% Cagr in 2023-2028, organic growth; largely in line with market growth due to superior execution and customer service “offset” by ongoing competitive pressure from bigger distributors who’re consolidating the market

Water treatment: +13% Cagr for 2023-2028, vs. 12.3% Cagr for 2012-2023, attributed from both organic growth and M&A; I used 2012 as the starting point for the comparison period because it marked the year when the company started acquisitions in the water segment; since then, it has consistently identified attractive targets within the sector, benefiting from both organic and inorganic growth for over a decade. I believe there is still ample room for the company to expand through the acquisition strategy

Health and nutrition: +4% pa, organic growth; mostly inline with market growth

Bottom line. Both Industrial and Health & Nutrition - the segments that rely on organic growth - have achieved stronger operating leverage in recent years, showing the company's ability to boost efficiency in established businesses. Margin tailwind will also come from increasing mix from the Water segment, which delivers the highest OPM among the three. Combining margin expansion with revenue growth, I expect the company's bottom line to grow Hsg% Cagr for the next 5 years.

Working capital management: as a distributor, one critical capability is how smoothly you run the inventory management for clients. Hawkins has delivered a very consistent/ stable cash cycle from 2015 to 2023, ranging from a very narrow window of 62 days to 65 days, showcasing its efficiently operated business machine, in an industry whose upstream has a lot of cyclicality.

Return on investment: all three return metrics have been improving - from 2019 to 2023, ROCE improved from 24% to 33% (+13.5 ppt); ROIC improved from 12% to 19% (+6.4 ppt); and ROE improved from 16% to 21% (+5.2 ppt). Covid inflation helped the situation - as increasing raw material prices have boosted distributors’ profits and earnings. Compared with peers, for the same period, Brenntag’s ROCE improved by 5.2 pct, ROIC improved by 2.6 pct, and ROE by 2.0 pct. Therefore, although part of the improvement should be attributed to “industry beta”, a big part of improvement comes company’s improved fundamentals through investing in areas that generate higher returns.

Capital allocations: since 2009 (to 2023), the company has deployed its FCF in the following manner (with average conversion rate from recurring net income to FCF ~150%):

45% on Capex: averaging 4.4% of sales. Capax ratio appears to be higher than peers’ (1.5-2% for Brenntag’s Essential business) - potential explanations include higher % on value-added (“manufactured, blended, and repackaged” products need higher density of machine and infrastructure investments to support operations), economy of scales (due to better route optimization etc.), higher % on owned vehicles (Hawkins operates a fleet of 250+ commercial vehicles), and higher site density required for water treatment business

45% on M&A: mostly carrying out tuck-ins for the Water business (12 out of 13 deals in the past decade), a market where I feel the company has clear competitive moats. Hawkins is a natural buyer in the industry, usually paying ~1x PS and gaining synergies in terms of region expansion. From our calculations, these 12 acquisitions have generated an NOPAT return of c.10% in 2023

25% on shareholder returns: has paid out an average of 25% net profit as dividends, contributing c.0.5-1% yield based on the recently heightened share price. Sbb has been about 1% of sales in recent 6 years and is contributing an <0.5% return. Overall, shareholder returns contribute c.1% yield now

-15% on debt: debt level has gone up, mostly because of the debt raising in 2015 to fund the Stauber deal

Valuation:

DCF: $96.6 target price, or 27.2% downside

P/E Multiples: I expect the company to be a Hsg% net income grower for the next 5 years, with 1% additional yield from shareholder returns. This profile is OK for the previous multiple of avg. 13x in 2021-2022, but at the current forward P/E of 30x+, it looks too expensive to me. Given the favorable seasonality in 2023 and typical 2-3 year cycles, I expect the company to experience unfavorable seasonality in the coming couple of years, resulting in margin headwind. Now seems an opportune time to Short the business.

Appendices:

Exhibit 1: List of health and nutrition suppliers/ partners that Stauber represents

Exhibit 2: List of Stauber’s competitors in the health and nutrition ingredient distribution business

Exhibit 3: Management background

CEO and President - Patrick H. Hawkins (age 53)

Nephew of previous CEO John R. Hawkins, who died in 2011 due to cancer

Appointed as President in 2010 as part of company's succession planning efforts

Prior served multiple roles incl. Director of Food & Pharma (2009-2010), Manager of Food (2007-2009), and Sales of Food (2002-2007); Joined the firm in 1992

CFO and Executive VP - Jeffrey P. Oldenkamp (age 51)

Assumed the role in FY2018, after previous long-term CFO Kathleen Pepski retired at 62

Previously CFO of MTS, a supplier of high-performance test systems and sensors

VP of General Counsel & Secretary - Richard G. Erstad (age 60)

Assumed the role in FY2009

Previously GC & Secretary of BUCA (2005-2008), and attorney at Faegre & Benson (1996-2005)

VP of Operations - Drew M. Grahek (age 54)

Assumed the role in FY2019, after previous holder Steven Matthews left to open his own supply chain consultancy (at age 47)

Previously faculty at University of Minnesota (2017-2018), Director of Supply Chain at Ulta (2016-2017), Director of Stores at Dick’s (2015-2016)