Deep Dive: Stella International (1836.HK)

Capitalize on luxury athleisure demand and high-end sports momentum; unique value proposition; 10% dividend yield + 10% earnings growth to drive ~20% IRR

Disclaimer: this research is for informational purposes only. This is NOT a recommendation to buy or sell securities discussed. Please do your ownwork before investing your money.

Capitalize on luxury athleisure demand & high-end sports momentum; Unique value proposition; 10% dividend yield + 10% earnings growth to drive ~20% IRR; Buy

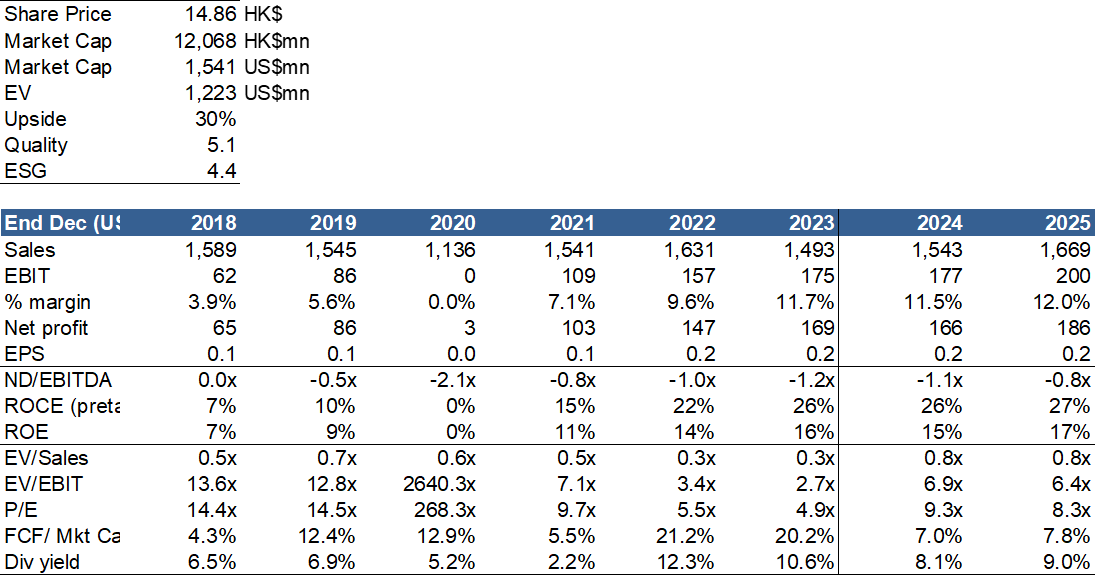

Date: Sep 3, 2024; Stock Price: HK$14.86; Target Price: HK$19.35 (30% upside)

Stella International caught my attention due to its impressive dividend yield in recent years. Upon deeper analysis, I discovered that the company also possesses strong earnings growth potential for the next 3-5 years, driven by demand from luxury brands and sports brand Nike. More fundamentally, the new management, in place since 2019, has brought significant changes to how the business is run with a stronger focus on ROIC and operational optimization. The price of the company is still attractive at 9x forward PE, considering its ~10% total shareholder returns (dividend + buyback) and the potential for a 10% compound annual earnings growth for the next 3 years.

Investment thesis

Strong dividend yield: the company has historically paid out ~80% of its reported earnings as dividend and been consistent with its payout; at 70-80% payout ratio, the company can generate close to 10% dividend yield based on the current valuation. The board has also approved distributing no more than $180mn excess cash over a 3-year period, which can bring an additional 3-4% yield every year

Capacity expansion: the company had stayed at ~60mn (pairs) capacity for almost a decade, but has recent initiatives to bring 15mn new capacity in the next 5-10 years; my analysis indicates that the expansion is well supported by demand in Luxury and high-end sports, potentially driving solid mid-term growth for the company

Nike’s high-end ambition: as one of the key OEMs for Nike’s high-end serieses, Stella stands to gain from Nike's strategic decision to expand in the high-end market, particularly with its Jordan brand. This strategic focus aligns well with the utilization ramp up of Stella's upcoming 10mn-capacity factory in Indonesia, set to open in 2026

Athleisure in Luxury: the company has made strides recently by acquiring ~15 new luxury logos looking to tap into the athleisure trend with sneaker lines. Leveraging its multi-batch manufacturing capabilities, skilled product development team, and experienced high-end workforce, Stella is well-positioned as the ideal partner for these luxury houses. The partnerships enhance Stella's financial positions by offering higher profit margin, faster payment terms, and enhanced client loyalty. Revenue from these new clients is expected to become more material from 2025

Unique value proposition: strong moat in premium shoemaking established by (1) an industry-leading, highly professional product development (PD) team that is dedicated to each client and provides best-in-kind guidance on product engineering and material - an offering highly sought after by high-end customers who prioritize product distinctiveness; (2) multi-batch manufacturing capability necessitates that individual workers excel across various processes and design types, prioritizing versatility and craftsmanship over mere efficiency; big OEMs find multi-batch production economics working against their set-up of hundreds of millions of pairs of capacity - this limitation safeguards Stella's position against potential pressures from the “big guys”; (3) a highly skilled workforce for complex shoe-making, developed through extensive training and multiple iterations through client projects, not something that can easily be acquired by competitors

Capable new management: in 2019, the company executed a smooth management transition, with Mr. Lawrence Chen stepping in as the new Chairman and Mr. Lo-Jen Chi assuming the CEO role; we value the new management’s shift in focus towards return on investment (vs. scale for the previous leadership), as well as its dedication to put executives and managers in their most suitable positions. This adjustment has led to significant enhancements in operational efficiency - ROCE surged from 10.1% in 2019 to 26.2% in 2023, and ROIC rose from 9.8% to 21.1%; sales per employee climbed from $29k to $36k, and FCF per employee grew from $2.9k to $4.1k

Robust financial health: the company maintains a strong cash position, sufficient to self-finance capex expansions and potentially enhance shareholder returns. Since 2018, the company has grown its cash reserves while maintaining minimal debt, achieving a net debt of $326mn by 2024H1. The balance sheet remains exceptionally healthy, presenting minimum risk of default amidst ongoing expansion efforts

Company history

Founded in 1982 in Taiwan by Jimmy Chen, Jack Chiang, and Eric Chao, the company began producing in China in 1991, taking advantage of the country's cost-effective and efficient labor. In 1998, it expanded its manufacturing operations to Vietnam through a JV, marking its first production efforts outside China. By 2004, the company had begun developing and manufacturing footwear for high-end brands. In 2006, it made a significant breakthrough by entering Nike's supply chain with production facilities in Wuhan, China. A year later, the company went public on the HKEX.

The company accelerated its international expansion by starting footwear production in Indonesia in 2012, Bangladesh in 2013, and the Philippines in 2014. Although earnings peaked in 2012, overconfidence led the management to expand aggressively, operating under the old adage "build it and they will come." However, the anticipated demand did not materialise, resulting in substantial excess capacity. This forced the company to seek lower-end Casual clients, typically more price-sensitive, leading to high client turnover and reduced profit margins.

It took the company multiple years (until 2018-2019) to recover from the mistake; in 2019, it conducted a smooth management transition with Lawrence Chen taking over as Chairman and Chi Lo-Jen becoming CEO. The new leadership brought a more professional approach, prioritizing return on investment and demonstrating strong execution skills, particularly in managing working capital and enhancing operating efficiencies. This new phase also marked a renewed focus on the Luxury segment and capacity expansion in international markets (Indonesia and Bangladesh). I feel the expansion this time around is much better supported by real demand from various clientele, potentially driving 3-5 years of high-quality growth for the company.

Competitive advantages and moats

Industry-leading product development team: highly professional and dedicated to each client; provides best-in-kind guidance on product engineering and material - an offering highly sought after by high-end luxury and fashion customers who prioritize product excellence and distinctiveness

Multi-batch productions: such capability requires individual workers to excel across various processes and design types, prioritizing versatility and craftsmanship over mere efficiency; big OEMs, like Yue Yuen and Feng Tay, find multi-batch production economics working against their set-up of hundreds of millions of pairs of capacity - this limitation safeguards Stella's position against potential pressures from the “big guys”

Skilled and experienced high-end workers: Stella has developed a workforce of tens of thousands of highly skilled workers who specialize in producing complex footwear with high efficiency (mostly in Vietnam and China); this level of expertise is developed through extensive training and multiple iterations across high-end client projects, something difficult for peers to acquire. Stella is the largest premium shoewear manufacturer in Asia and is consistently placed within the top 10 percentile of brands’ vendor evaluations

Track record: Stella's extensive experience in collaborating with high-end clients on intricate footwear sets it apart from other players in the industry; building credibility within this sector is crucial for winning over high-end customers, particularly luxury brands. Feedback from the sell-side suggests that it's uncommon to encounter a company with a track record nearly as deep as Stella's

Sports (43% of revenue in 2023)

Customers: Nike (20mn dedicated capacity, vs. 60mn Group total), Hoka (growing strongly), Saucony, and Vivobarefoot…

Nike is a high quality customer that offers quick payment, transparent communication, and close collaboration with vendors; it pays for capex depreciation of unused capacity dedicated to its production, reducing vendors’ operational risks during downturn

Nike has demonstrated a strong desire to expand its high-end Jordan brand: in its latest earnings call, Nike highlighted the considerable potential of its Jordan brand and its strategy to elevate it to the "No.2 footwear brand in North America not named Nike" through increased investment (Jordan’s 2022 North America revenue was $5-6bn vs. $6.7bn for Adidas). This focus is promising for Stella’s operations as a key manufacturer for the high-end series and may underpin its planned 10mn capacity expansion in the new 2026 Indonesia factory

Luxury (10% of revenue in 2023)

Customers: Balenciaga (biggest), Chloe, Lanvin, Jimmy Choo, Moncler, Sergio Rossio, Kenzo…

Stella acquired ~15 new logos in the past 3 years: as luxury brands seek to enter athleisure, they turned to Asia, seeking high-quality, efficient production that European factories cannot offer. As the largest premium shoemaker in Asia, Stella's industry-leading PD team, strong high-end workforce, and efficient multi-batch capability make it an ideal (and sometimes the only qualified) partner for these clients. Typically, new luxury partnerships take 1-2 years for product co-development and testing; after this, these partnerships may each generate 100-300k annual orders if the client decides to greenlight the design. We expect more significant revenue contribution from new luxury logos after 2024

Luxury brands are also considered high-quality clients due to the high-margin they bring, their fast payment, and their strong loyalty (particularly after establishment of close relationship with the chief designers); Stella aims to boost revenue contribution from luxury clients in the coming years, driving increased ASP and margins

Fashion: (26% of revenue in 2023)

Clients: Cole Haan (largest), Tory Burch, Michael Kors, Lacoste…

Stella aim to grow Fashion + Luxury to 40%+ of Group revenue in mid-term

Casual (21% of revenue in 2023)

Clients: UGG, Timberland… clients in this segment tend to be more price sensitive

Revenue contribution has been declining, from close to 50% in 2015 to 21% in 2023; the company aims to further reduce its contribution to below 15%

Management

Smooth leadership transition: prior to 2019, the company had been led by Mr. Jack Jeh-Chung Chiang (Chairman, 68 yrs old in 2018) and Mr. Eric Ming-Cheng Chao (deputy Chairman, 67 yrs old in 2018); both are co-founders of the company. In 2019, a new management team took the helm with Mr. Lawrence Li-Ming Chen (58 yrs old in 2018) taking over as Chairman, and Mr. Lo-Jen Chi (47 yrs old in 2018) assuming the CEO role. The company had been strategically preparing for such a transition; Lawrence had been Group CEO since 2007, and Lo-Jen had been pivotal in Group’s expansion into the high-fashion segment, a key growth driver for the company now

New leadership approach: the current management places a strong emphasis on ROIC in their decision-making, contrasting with the previous management's focus on scaling, which partially caused the operational challenges experienced between 2012 and 2018. Since the new management assumed their roles, there have been notable improvements in the company's operational efficiency - ROCE surged from 10.1% in 2019 to 26.2% in 2023, and ROIC rose from 9.8% to 21.1%; sales per employee climbed from $29k to $36k, and FCF per employee grew from $2.9k to $4.1k. As shared by an investment industry contact of John following his visit to Stella's China HQ, local executives and managers have felt noticeable strategic and operational shifts under the new management

Financials and valuations

Top line: 5-10% Cagr for 2023-26, mainly driven by the following three elements:

ASP: 2-3% Cagr due to normal inflation and higher mix from Luxury (9.5% of revenue in 2023 to 14.4% in 2026, $50+ ASP) and lower mix from Casual (21% in 2023 to 14.3% in 2026; ~$20 ASP)

Capacity expansion: Bangladesh (~5mn capacity, planned inauguration in late 2024) and Indonesia (10mn capacity dedicated for Nike, planned inauguration in 2026) will bring 25% more capacity to the Group in the next 5-10 years; both plants are on track for their respective inauguration

Utilization rate: non-Nike capacity at full utilization now due to industry recovery and promising new demand from luxury clients; Nike factory utilization expected to recover in 2024 and onward thanks to the brand’s effort in 2023 to clear excess stocks, as well as its determination to expand in high-end where it heavily relies on Stella’s superior production qualities

Bottom line: 10% Cagr for 2024-26; firm launched a 3-year plan, targeting 10% OPM (+2 ppt increase from 2022 level) and low-teens Profit after-tax Cagr

2023: OPM performed better than expected, with 10%+ (reported) OPM already achieved. Looking ahead, I believe the company can further enhance its margin by 1 ppt through revenue mix shifting toward higher GPM categories such as Luxury, operational efficiency improvements and elimination of non-recurring items, offset by higher D&A costs due to capacity expansion

Source of improvement: (1) product mix shift to more high-end categories (Luxury and Fashion contributing 40%+ revenue in 2026); (2) capacity expansion to enhance economy of scale; (3) reshoring to place more capacity in Indonesia and Bangladesh which have lower human capital costs vs. Vietnam and China; (4) increasing automation/ digitalization and centralizing R&D/ BD to improve operational efficiency

Working capital management: under the new management's leadership, the company has seen significant improvement in its working capital management. As the company's EBIT expanded by over $100mn (from $62mn in 2018 to $175mn in 2023), its working capital saw a reduction of over $200mn+ during the same period; additionally, net working capital as % of revenue dropped from 31% in 2018 to 18% in 2023. These changes materially improved the company’s return metrics such as ROCE and ROIC. More specifically, the new management:

Created customer scorecard to rank customers based on gross profit per working capital - expanded with the high-return ones (like Balenciaga) and phased out the least efficient ones

Created customer financial credit scorecard to pay more attention to those with high liquidity risks

Reduced inventory level by sending finished products to clients earlier, more frequently, and in smaller batches, minimizing the amount of inventory on hand

Extended supplier payment terms

Capital allocation (cumulatively from 2009 to 2023):

44% on Capex: average 4.1% of revenue (5.5% during 2011-2013 expansion phase and 3.6% during 2017-2022 no expansion phase)

58% on Dividend: distributing cumulatively ~80% of earnings as dividends, driving a dividend yield close to 10%

-2% on change in cash balance

0% on SBB so far: the company board has approved $180 million SBB/ special dividend initiative over the next 3 years (2024-2026). A review of the balance sheet suggests that such program is well supported by the company’s financials - Stella’s capex needs of $200mn for 2024-2025 can be met with $140mn cash reserved from the current net cash balance (total ~$326mn) and operating cash flow generation, leaving $180mn excess cash potentially generating an additional 3-4% yields every year

Valuation: ~10% yield (dividend + additional yield from share repurcases/ special dividend), coupled with a 10% earnings growth, shall drive a ~20% IRR without multiple re-rating. My DCF (12% WACC, 1% terminal growth) suggests a 30% upside from the current price.

Pre-mortem

(I use pre-mortem instead of risk analysis to encourage more proactive problem identification)

Nike’s ambition to grow its high-end brand Jordan met serious roadblock, prompting a strategic shift to other directions; as a result, Stella's planned 10 million capacity expansion in the 2026 Nike-dedicated factory in Indonesia became redundant

Nike experienced a decline in market share in the Sports market, leading to a reduction in its operations; this downsizing affected all major OEMs that relied on its orders

Post-Covid, luxury brands decided to shift away from athleisure sneakers and concentrate only on designer shoes

Internal conflicts within the family disrupted the operational improvements that new management had implemented over the past 3-4 years

Sudden change in dividend policy to pay significantly less dividend than the current level

Growth momentum stalled, leading to a decrease in the company's valuation multiple from the current level of 9x forward P/E

The recent slowdown in the Chinese luxury consumption trend is evident in the earnings of the European luxury brands like Hermes and LVMH. Nike itself is also experiencing slower growth due to its mishaps coming out of Covid. How do you think this will impact Stella?

What about margin durability? Do you think 10/12% EBIT is sustainable? Manufacturers tend to have a lot of operational leverage